Small business payroll tax calculator

Get Started for Free. Well run your payroll for up to 40 less.

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

Lets say for example you earned exactly 137700 at your job and 10000 from your business.

. For the 2020 tax year employers and employees both pay 62 of the employees wages toward Social Security the total contributions must equal 124. Enter your employees pay information Most employers use this paycheck calculator to calculate an employees wages. Payroll management made easy.

Ad Payroll So Easy You Can Set It Up Run It Yourself. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Learn About Payroll Tax Systems. Multiply each employees gross pay for the. Small Business Low-Priced Payroll Service.

Small Business Payroll Calculators 8 FREE payroll calculators for you and your employees If youre looking to calculate payroll for an employee or yourself youve come to the right place. Big on service small on fees. 4 Steps to Calculating FICA Payroll Taxes Calculating FICA payroll taxes includes four steps.

The first 137700 of wages are subject to the. Calculate Social Security withholding. The calculator on this page is provided.

There are also limits to the SECA tax. How to calculate your employees paycheck Step 1. Ad Make Your Payroll Effortless and Focus on What really Matters.

This calculator would say you owe 0 in Social Security taxes on that 10000. Business Payroll Tax Calculator GTM provides this free business payroll tax calculator and overtime calculator to help you find out what your employees taxes standard hourly rate of. Sign Up Today And Join The Team.

Compare Side-by-Side the Best Payroll Service for Your Business. Over 900000 Businesses Utilize Our Fast Easy Payroll. Learn About Payroll Tax Systems.

Starting as Low as 6Month. 62 for Social Security and 145 for Medicare. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C.

Free Unbiased Reviews Top Picks. Important note on the salary paycheck calculator. Sign Up Today And Join The Team.

Free Unbiased Reviews Top Picks. All Services Backed by Tax Guarantee. Some tips for finding matches for Small Business Payroll Taxes Calculator.

Ad Run your business. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Small Business Low-Priced Payroll.

To learn more about small-business employers payroll duties and obtain the relevant forms go to the IRS website or call the IRS live helpline for businesses at 1-800-829. Calculate Tax Print check File tax form W2 W3 940 941 Free Trial. Both you and your employee contribute 765 to FICA.

3 Months Free Trial. Withhold 62 of each employees taxable wages until they earn gross pay. Get your payroll done right every time.

Find out how easy it is to manage your payroll today. Ad Compare This Years Top 5 Free Payroll Software. The SECA tax is calculated on the basis of net earnings which is gross income minus any expenses incurred while doing business.

Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Designed for small business ezPaycheck is easy-to-use and flexible.

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Over 900000 Businesses Utilize Our Fast Easy Payroll. The standard FUTA tax rate is 6 so your max.

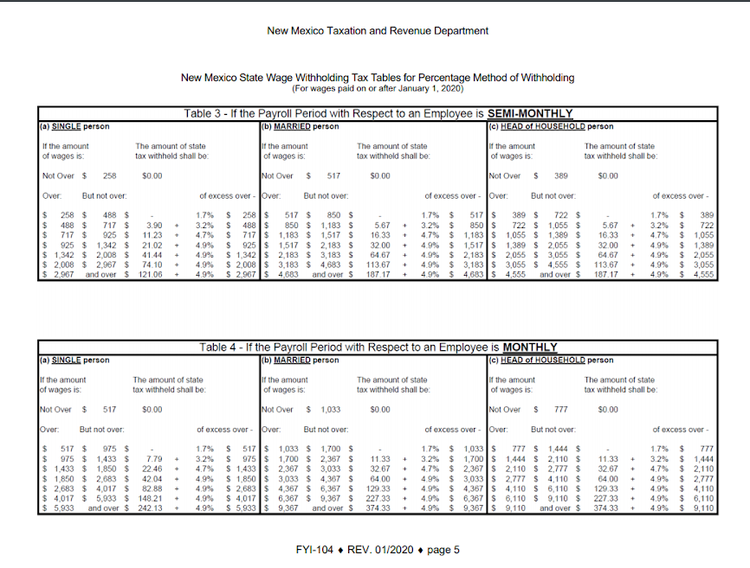

Ad Compare This Years Top 5 Free Payroll Software. We provide aggregated results from multiple sources and sort them by user interest updated every 45 minutes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

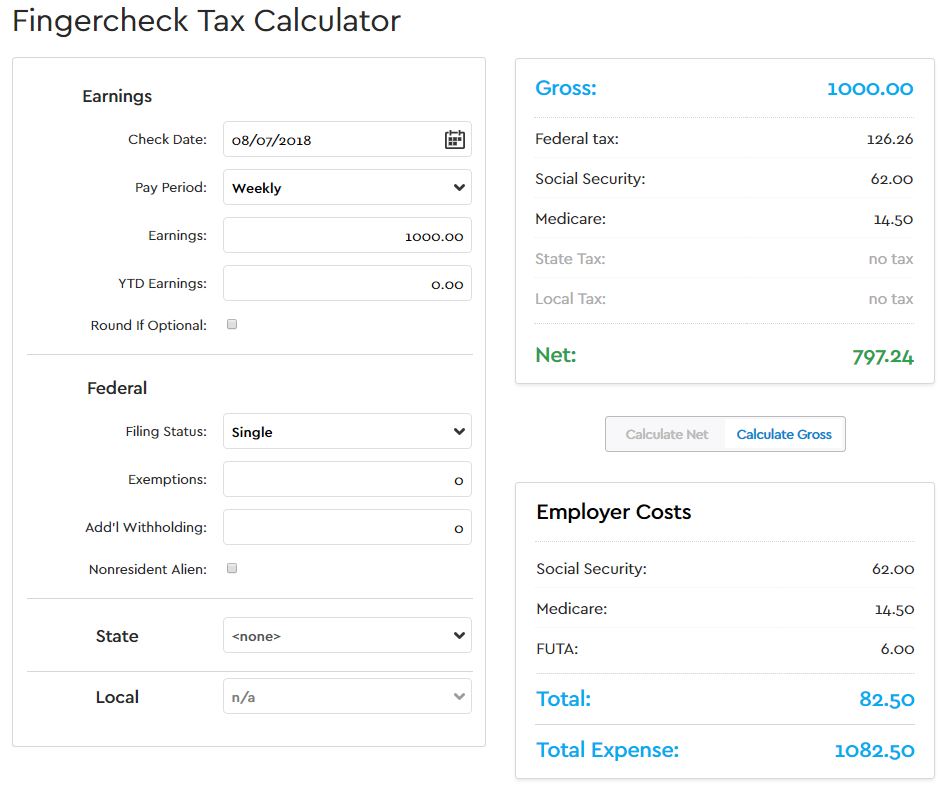

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Payroll Tax Calculator for Businesses GTM provides this free business payroll tax calculator and overtime calculator to help you find out what your companys employees taxes standard.

For example if an employee earns 1500 per week the individuals annual. Youre guaranteed only one deduction here effectively. The calculator includes options for estimating Federal Social Security and Medicare Tax.

How To Calculate Taxes On Payroll Outlet 55 Off Www Ingeniovirtual Com

How To Do Payroll Yourself For Your Small Business Gusto

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

How To Calculate Payroll Taxes For Your Small Business

Small Business Payroll Taxes How To Calculate And How To Withhold Netsuite

How To Calculate Payroll Taxes For Your Small Business

Employer Payroll Tax Calculator Incfile Com

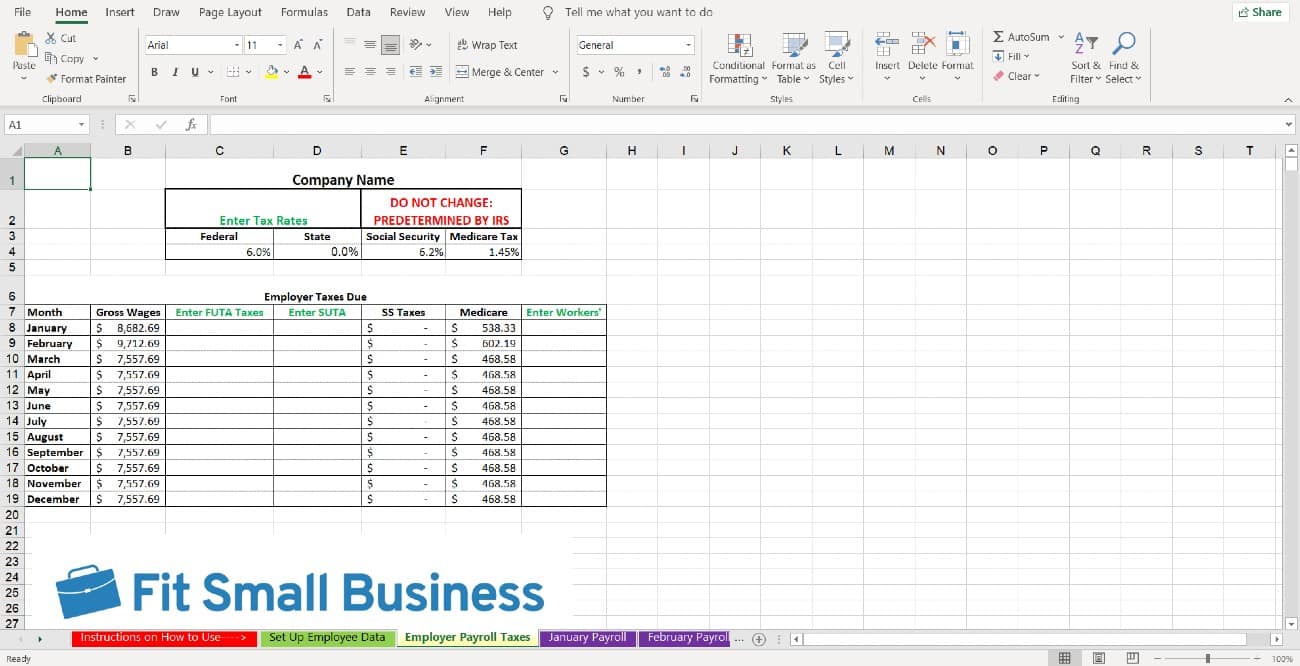

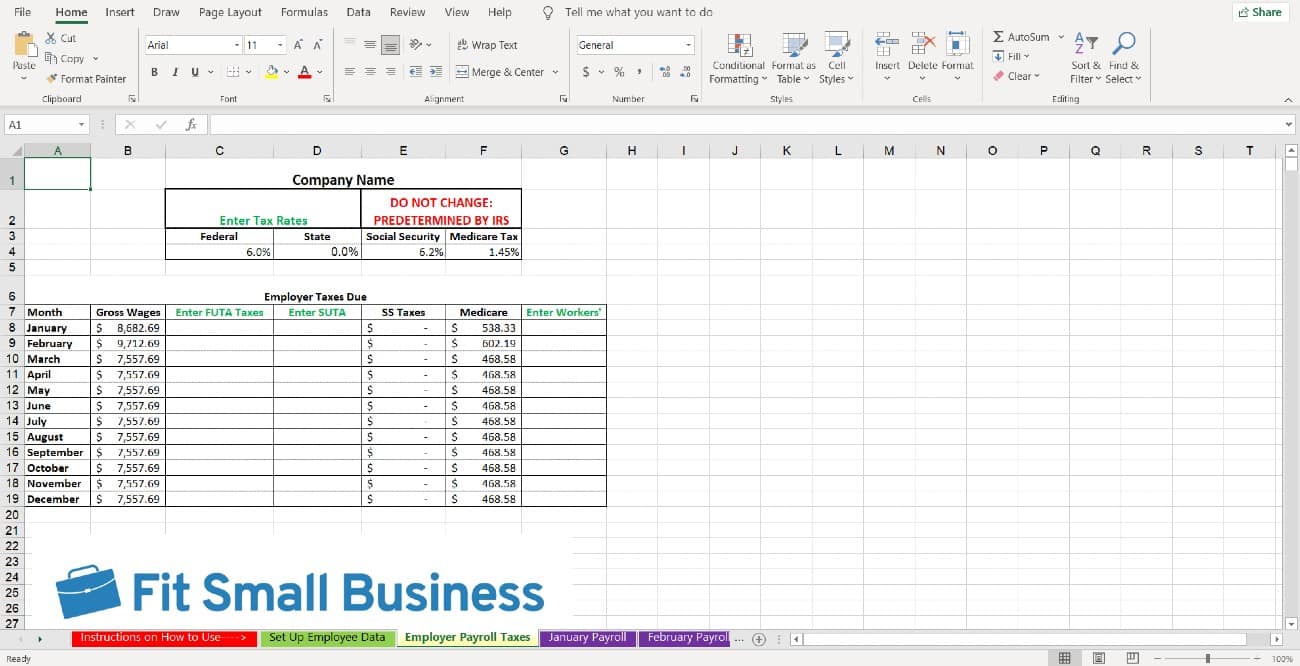

How To Do Payroll In Excel In 7 Steps Free Template

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

How To Calculate Payroll Taxes For Your Small Business

Calculating Payroll Taxes 101 For Small Business Owners

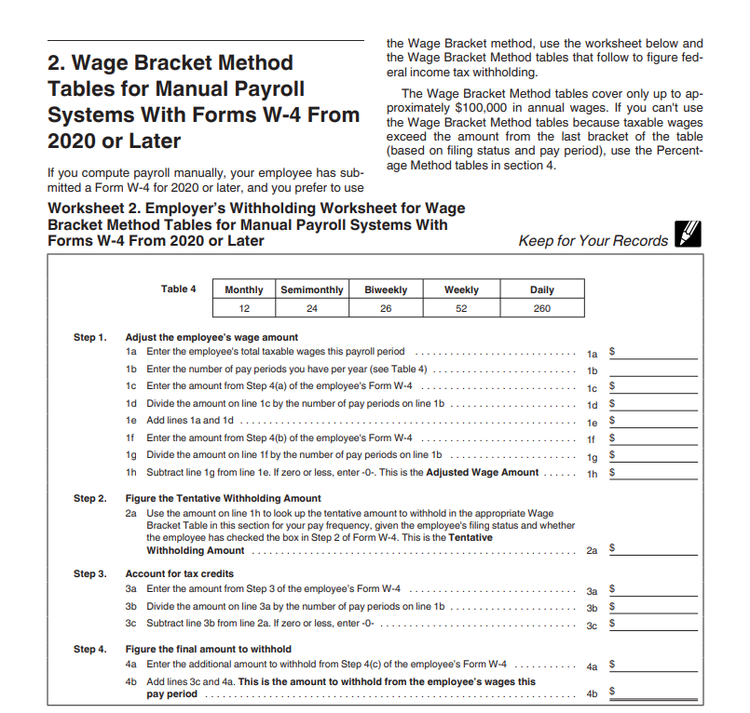

Federal Income Tax Fit Payroll Tax Calculation Youtube

How Much Does A Small Business Pay In Taxes

Payroll Tax Calculator For Employers Gusto

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

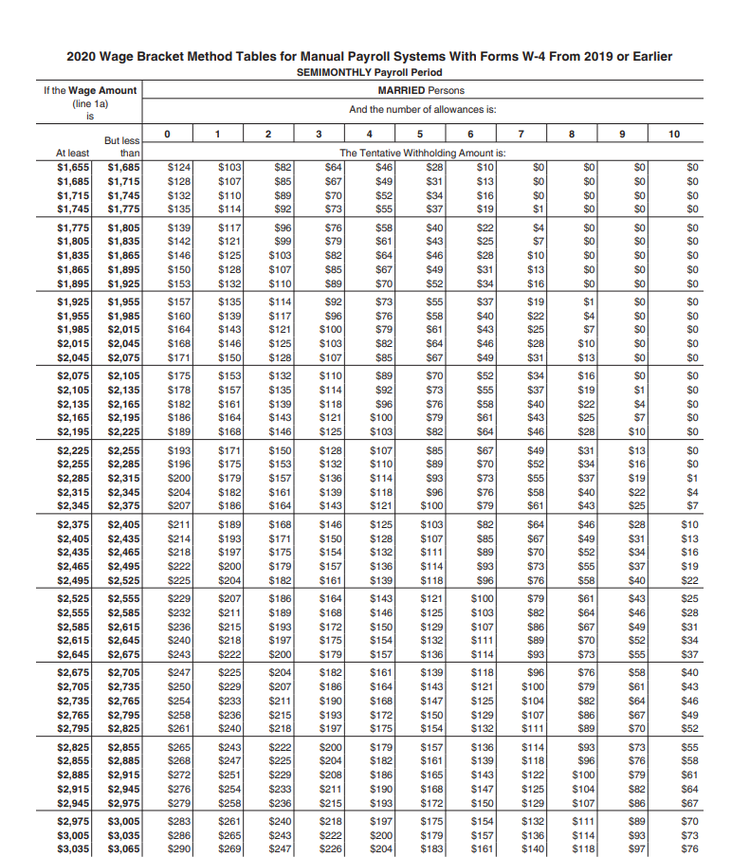

How To Calculate 2019 Federal Income Withhold Manually